Passed on 12 February – and coming into effect in the first and second half of 2024, and in early 2025 – the Fair Work Legislation Amendment (Closing Loopholes No. 2) Bill 2023 introduces statutory guidance for defining the relationship between an employer and a worker.

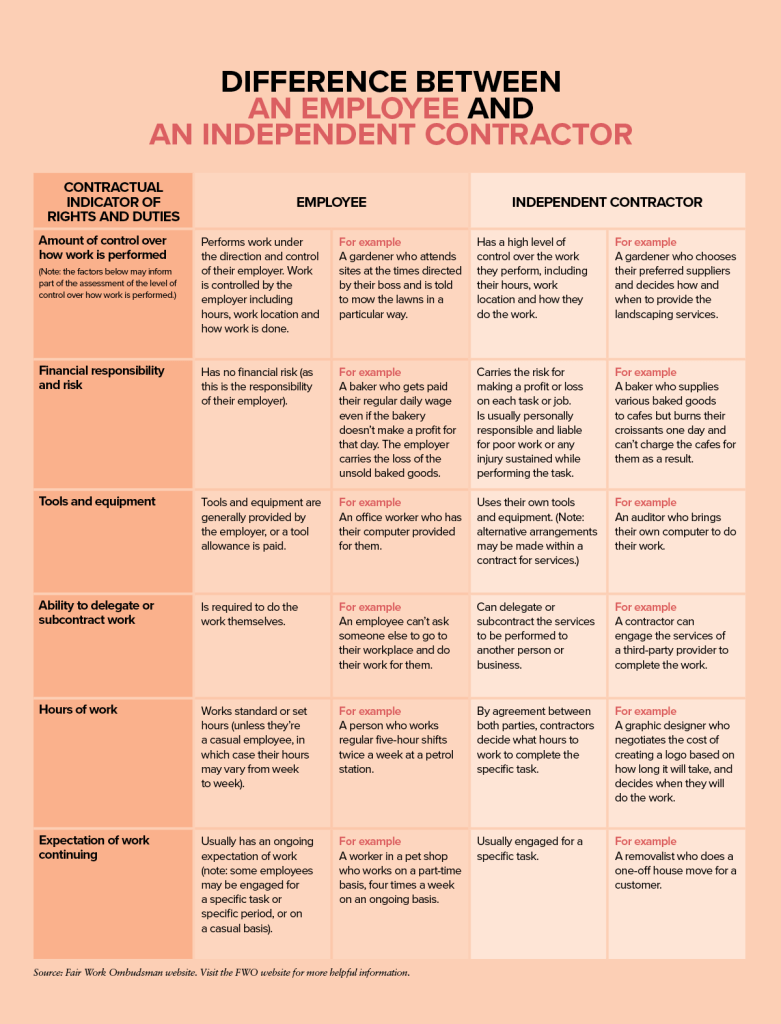

To determine whether a worker is an independent contractor or an employee, regard must be had to the totality of the relationship between the parties. This means a multifactorial test will apply. Factors include, but are not limited to:

- Who controls the work performed, and how it is performed.

- Where financial responsibility and risk lies.

- Who supplies the tools and equipment.

- The worker’s ability to delegate or subcontract the work.

- Whether the worker is engaged by other businesses.

- The expected work hours.

- The expectation of work continuing.

Prior to this law change, where a contract exists, the employer-worker relationship should be determined by that contract – and the multifactorial test should only apply in the absence of a contract. Under the new law, the practical reality of the working relationship should always be considered, whether there’s a contract or not. In short, an employer can no longer simply point to a contract to prove that a worker should be considered a contractor rather than an employee.

How can Managers and HR prepare?

Firstly, review existing engagements with independent contractors. If it emerges that, despite a contract, an arrangement resembles an employer-employee relationship, then the employer should make adjustments to ensure the worker receives appropriate entitlements and rights, such as general protections.

Template contracts should be examined particularly thoroughly to ensure there are no unfair contract terms. Terms that could introduce risk might include paying a contractor less than an employee for the same work, placing restrictions on the contractor or insisting on unreasonable working hours.

In addition, HR should be aware that high earners who are already contracted can choose to retain contractor status. The contractor high income threshold has not been set, and it may be the same as the employee high income threshold, which is $167,500.

Finally, it should be noted that the changes won’t apply to businesses that are only “national system employers” due to a state’s referral of powers to the Commonwealth.